Key Takeaways

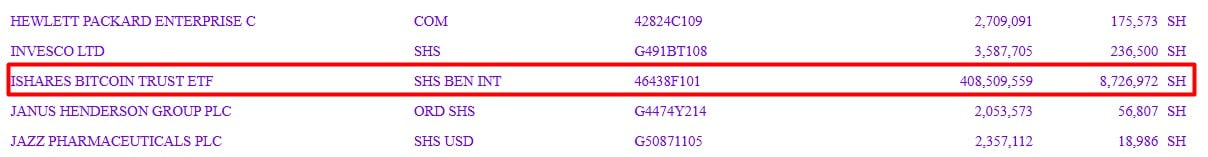

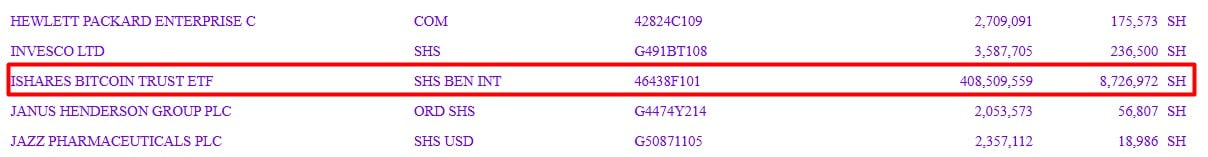

- Mubadala Investment Company increased its holdings in BlackRock’s spot Bitcoin ETF to 8.7 million shares valued at $408 million.

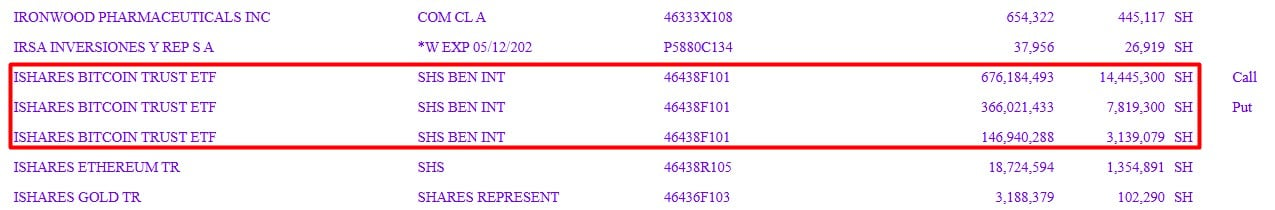

- Citadel Advisors expanded its IBIT holdings to over 3 million shares worth approximately $147 million.

Share this article

New SEC filings reveal that Abu Dhabi’s Mubadala Investment Company and Citadel Advisors have increased their holdings in BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT), a sign of sustained institutional interest in crypto-related assets despite recent market volatility.

Mubadala Investment Company, Abu Dhabi’s sovereign wealth fund, increased its holdings in BlackRock’s spot Bitcoin ETF to 8.7 million shares valued at $408 million as of March 31, according to a Thursday filing.

This represents an uptick from the 8.2 million IBIT shares held at the end of last year. However, the total value of the holdings fell from $436 million to $408 million due to a decline in the share price.

Between December 31, 2024, and March 31, 2025, IBIT’s share price dropped from around $54 to approximately $47, according to Yahoo Finance data. The ETF’s shares closed Thursday down slightly at $58.

Citadel Advisors also expanded its IBIT position in Q1 2025. According to a Thursday filing, the firm held over 3 million IBIT shares worth approximately $147 million, up from around 1 million shares in December.

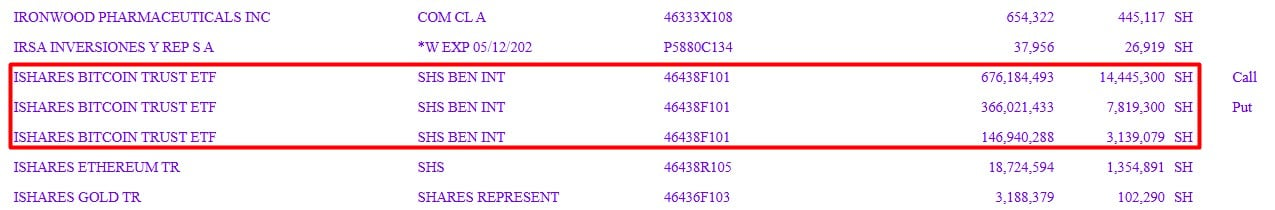

In addition, Citadel Advisors reported holding $676 million in call options and $366 million in put options tied to IBIT.

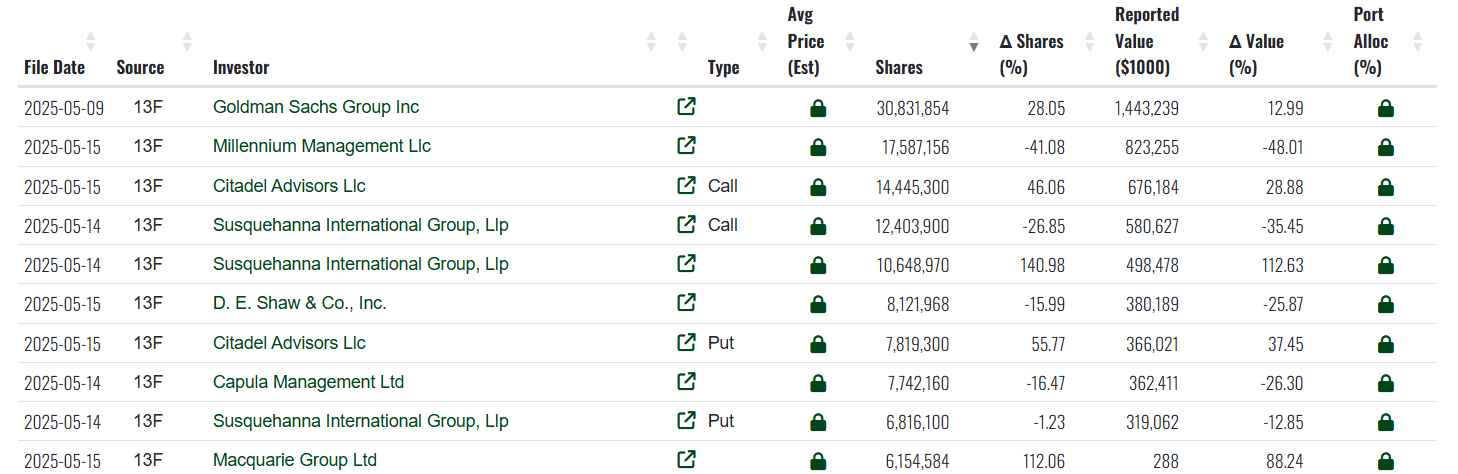

Mubadala and Citadel Advisors join other major institutional investors, including Goldman Sachs and Avenir Group, in expanding their IBIT exposure. However, not all large holders are increasing their stakes.

The State of Wisconsin Investment Board exited its entire $321 million position in BlackRock’s Bitcoin ETF, according to a recent SEC filing. Despite the divestment, the board still holds crypto-related assets, including nearly $19 million in Coinbase stock.

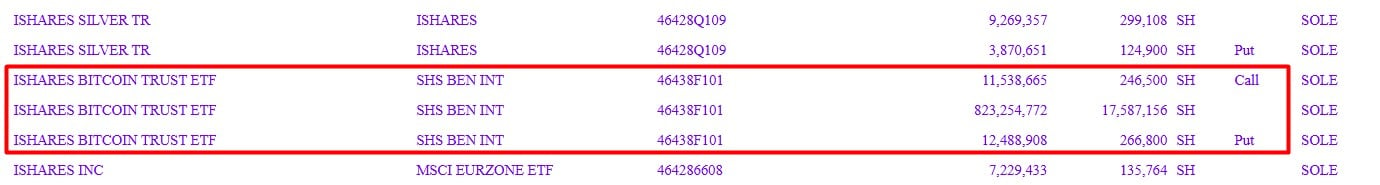

Millennium Management, previously the largest IBIT holder, on Thursday reported owning about 17.5 million shares as of March 31, valued at approximately $823 million. This is down from the 29.8 million shares worth $1.5 billion disclosed in its February filing.

Millennium’s new filing also revealed options exposure to IBIT, including $11.5 million in call options and $12.5 million in put options.

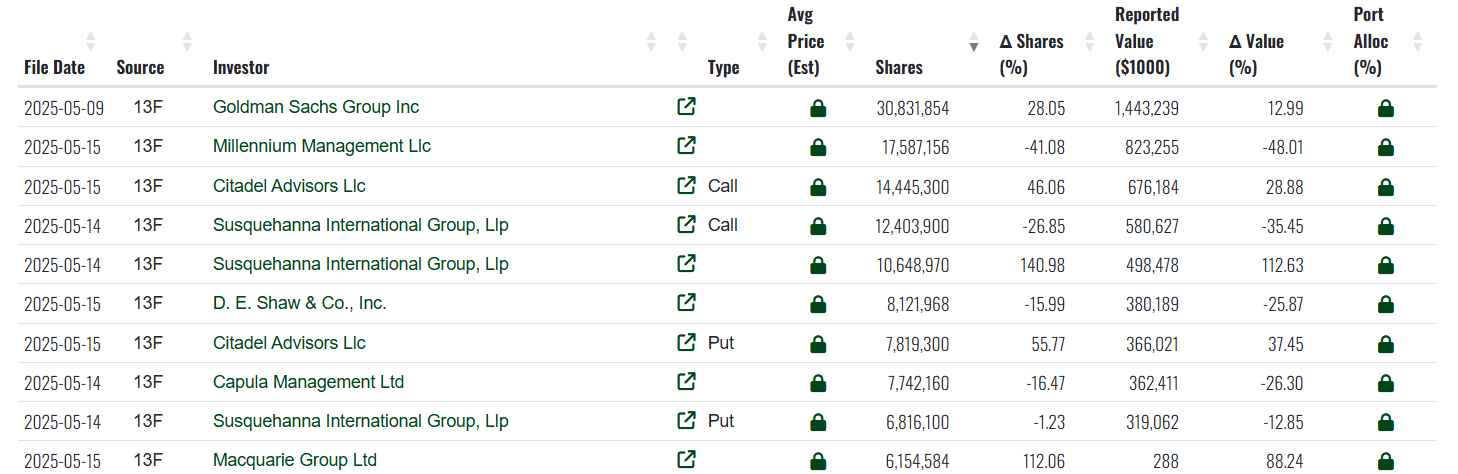

Millennium remains one of IBIT’s top shareholders. According to the latest data tracked by Fintel, the firm is the second-largest institutional holder, behind Goldman Sachs. Citadel ranks third, followed by other major stakeholders such as Capula Management and D.E. Shaw & Co.

Share this article