Xapo Bank, the Gibraltar-based private bank that has been at the forefront of bitcoin-friendly services, has launched a new bitcoin-backed lending product.

This loan, available only to select pre-approved customers, allows long term bitcoin holders to borrow up to $1 million in cash without selling their BTC. The bank is trying to solve the problems that have plagued the bitcoin lending space in the past.

Many bitcoin investors don’t want to sell their holdings, especially if they think the asset will go up over time. With Xapo Bank’s new lending product, members can now borrow against their bitcoin holdings and keep their assets intact.

Xapo Bank CEO Seamus Rocca said, “Bitcoin is the perfect form of collateral — it’s borderless, highly liquid, available 24/7 and easily divisible, it’s uniquely suited for lending.”

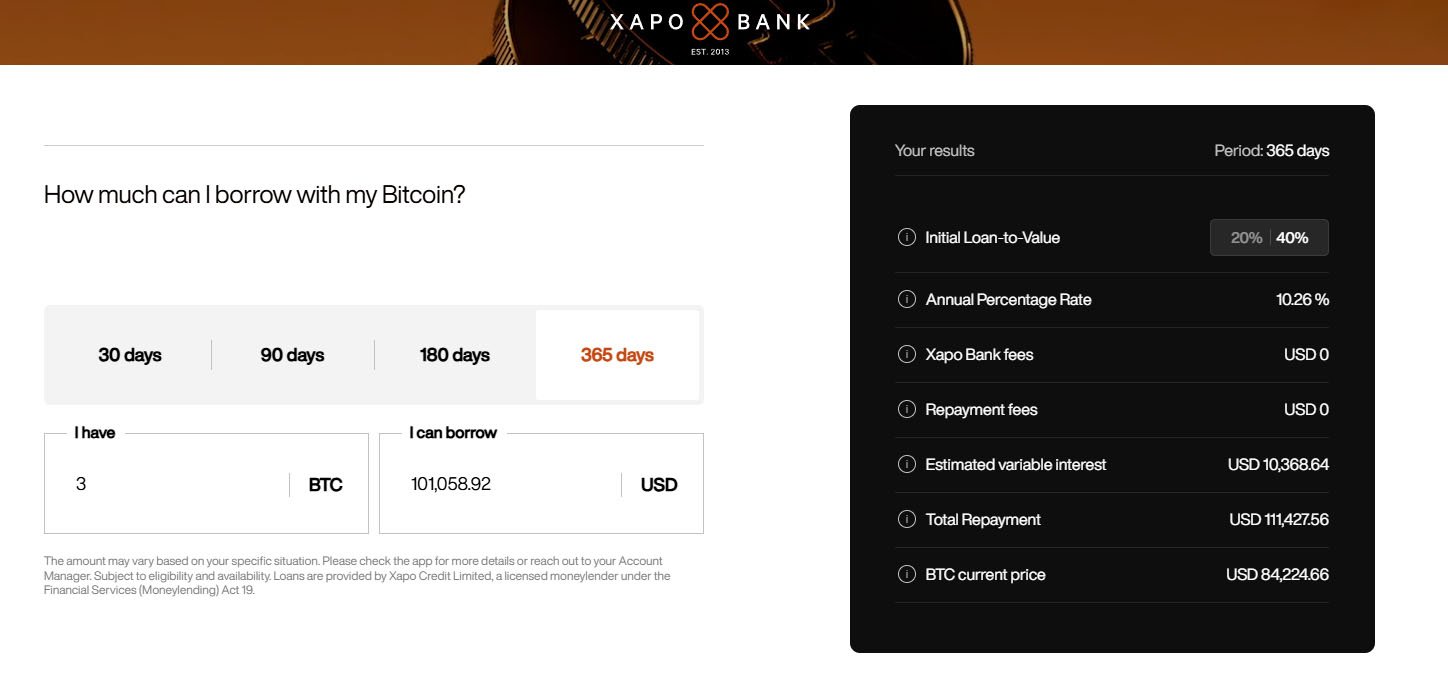

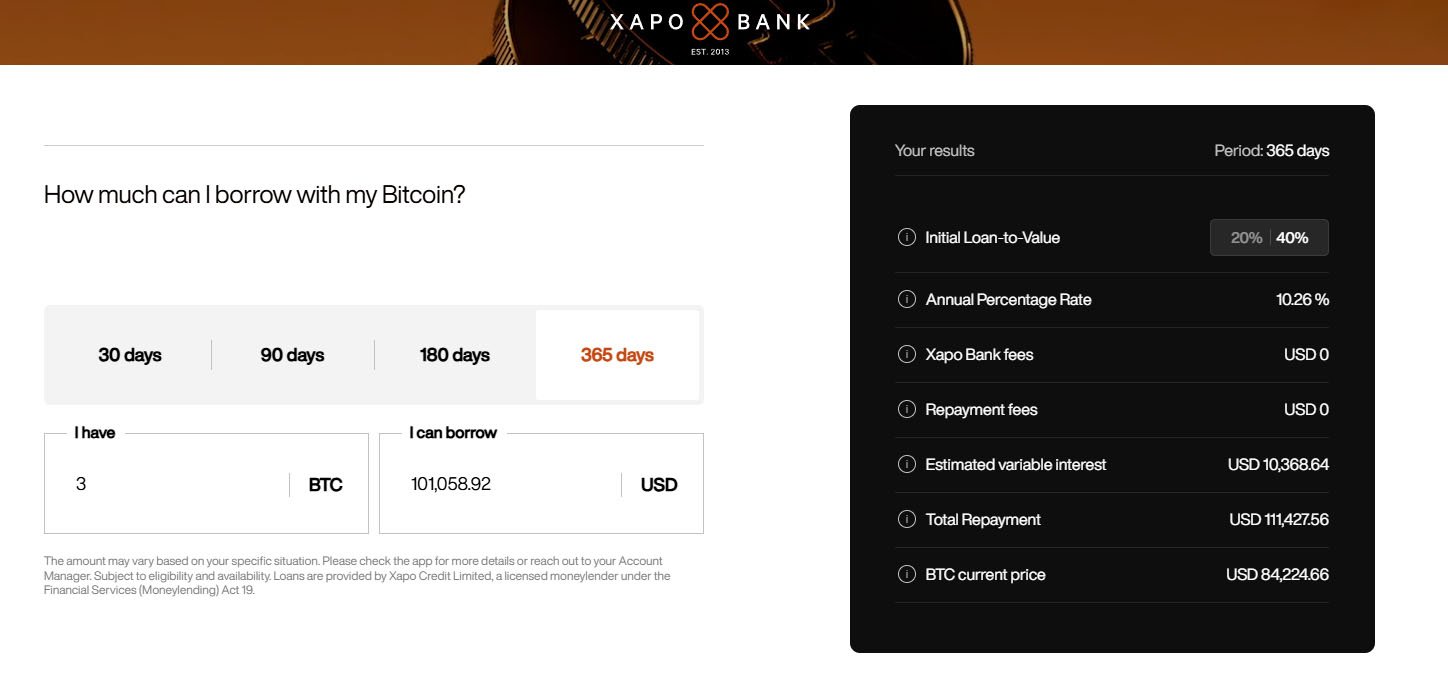

The bank has repayment terms from 30 days to 1 year with no penalties for early repayment. Borrowers can track their loan in real time using Xapo’s loan health tracker which gives instant updates on risk and repayment requirements.

Xapo Bank is taking a conservative approach to lending with a loan-to-value (LTV) ratio of 20%-40% to protect customer assets. That means if bitcoin crashes, borrowers will have enough cushion to prevent forced liquidation.

Xapo doesn’t rehypothecate, meaning customers’ bitcoin is not used for other loans or investments. Xapo’s bitcoin is stored in institutional-grade vaults using multiparty computation (MPC) custody.

Xapo Bank’s bitcoin-backed loans are designed for long-term bitcoin holders who need liquidity for big expenses. The bank sees borrowers using these loans for real estate, home upgrades or big personal investments like a car.

Rocca explained why this is attractive to bitcoin investors, saying:

“If you’re a bitcoin holder and you have conviction that the price of bitcoin is going to go up, selling any of it is hard to do. But sometimes life gets in the way: You need to upgrade your kitchen, you have school fees to pay.”

To be eligible for a loan, borrowers need to be pre-approved based on their bitcoin holdings and investment history. Xapo Bank says the service is available in Europe and Asia and most other jurisdictions but not in the U.S., due to regulatory restrictions.

Bitcoin-backed lending has had a bad reputation since Celsius and BlockFi went down in 2022.

Many investors lost money due to reckless lending and now exercise more caution, prioritizing platforms with a proven track record in bitcoin custody and those that offer secure and transparent solutions—especially those that don’t rehypothecate.

The renewed interest in bitcoin lending is not limited to Xapo.

Other big players like Coinbase and asset managers like Bitwise have also brought back bitcoin lending products this year. But Xapo differentiates itself by positioning its service as a wealth management tool not a high-risk lending product.

“If an exchange is offering you secured lending, it’s to encourage leverage,” Rocca explains. “And the moment you have leverage, unless you’re a professional investor — and even when you are a professional investor — the risk of losing money is very high.”