Key Takeaways

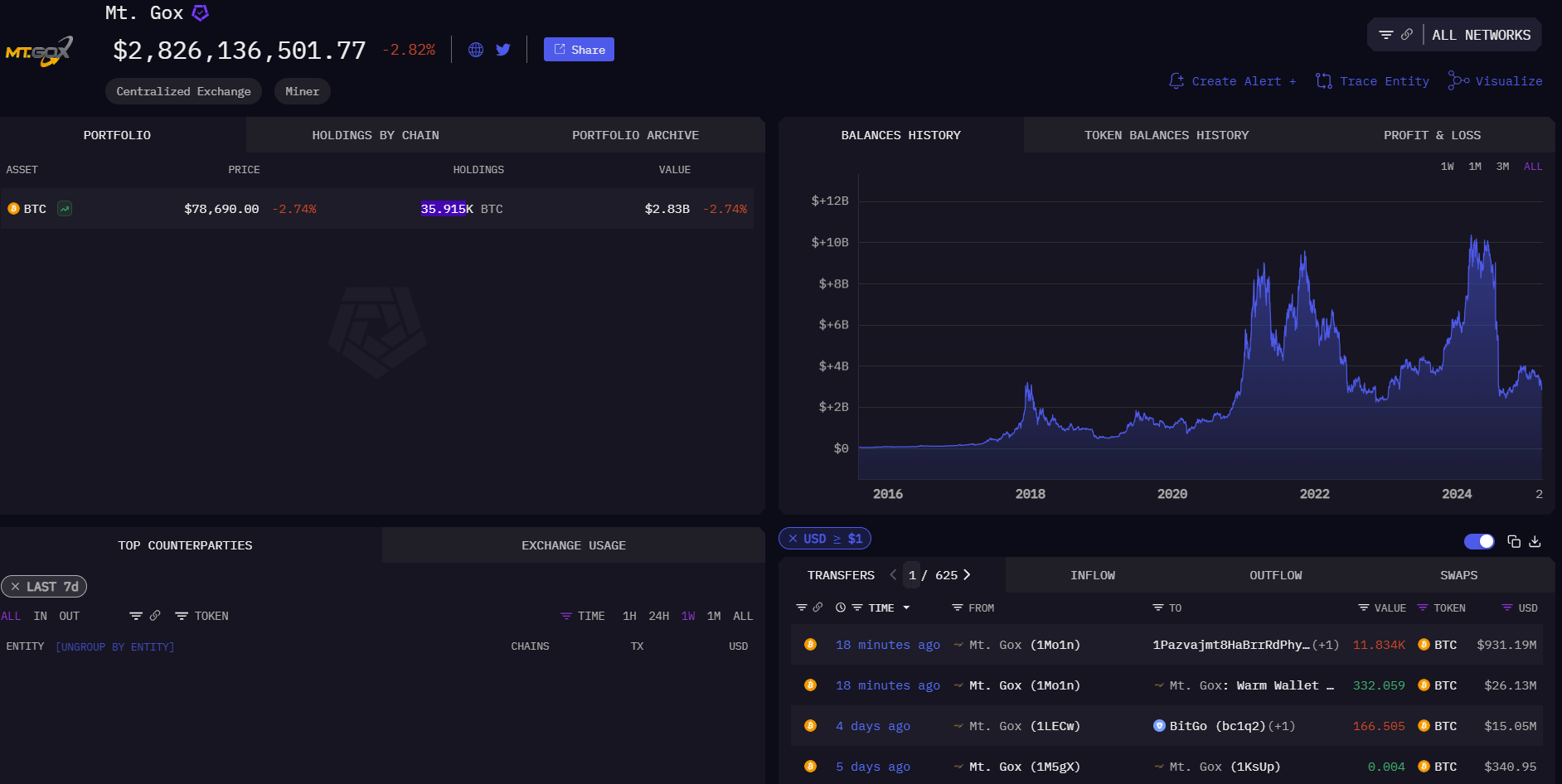

- Mt. Gox transferred 11,501 Bitcoin, worth about $905 million, to an unmasked wallet after a test transfer to BitGo.

- Mt. Gox still holds over 35,915 Bitcoin, valued at approximately $2.8 billion at current market prices.

Share this article

Mt. Gox, the now-defunct crypto exchange, transferred 11,501 Bitcoin, worth approximately $905 million, to an unmasked address in the past hour, following a 166 BTC transfer to BitGo last Friday, according to data from Arkham Intelligence.

These transfers came after Mt. Gox moved over $1 billion in Bitcoin to a new wallet beginning with “1Mo1n” last week.

This wallet, later masked as the entity’s new wallet, moved $931 million in Bitcoin today, with about $905 million going to an unidentified wallet and the remainder to the entity’s warm wallet.

Mt. Gox retains ownership of more than 35,915 Bitcoin, currently valued at approximately $2.8 billion at market prices.

The move comes after Bitcoin’s sharp decline, with prices falling below $77,000, deepening its correction after a weak start to the week, per CoinGecko.

BitMEX co-founder Arthur Hayes anticipates a possible retest at $78,000. “If we get into that range it will be violent,” Hayes said, noting substantial Bitcoin options open interest trapped in the $70,000 to $75,000 range. If the $78,000 level doesn’t hold, he suggests $75,000 could be the next target.

According to Ryan Lee, Bitget Research’s chief analyst, if Bitcoin fails to maintain the $77,000 support level, it could test the lower range of $70,000–$72,000. Conversely, a recovery could see a bounce from $75,000, pushing the price back into the $80,000–$85,000 range.

“The most likely scenario for this week suggests a mid-week test of $72,000–$75,000, with Bitcoin stabilizing near $83,000 by March 18-19, depending on broader market sentiment, external factors like regulatory news and the upcoming FOMC meeting,” Lee noted in a Monday statement.

Share this article